ТОР 5 статей:

Методические подходы к анализу финансового состояния предприятия

Проблема периодизации русской литературы ХХ века. Краткая характеристика второй половины ХХ века

Характеристика шлифовальных кругов и ее маркировка

Служебные части речи. Предлог. Союз. Частицы

КАТЕГОРИИ:

- Археология

- Архитектура

- Астрономия

- Аудит

- Биология

- Ботаника

- Бухгалтерский учёт

- Войное дело

- Генетика

- География

- Геология

- Дизайн

- Искусство

- История

- Кино

- Кулинария

- Культура

- Литература

- Математика

- Медицина

- Металлургия

- Мифология

- Музыка

- Психология

- Религия

- Спорт

- Строительство

- Техника

- Транспорт

- Туризм

- Усадьба

- Физика

- Фотография

- Химия

- Экология

- Электричество

- Электроника

- Энергетика

B Common money market instruments

- Treasury bills (or T-bills) are bonds issued by governments. The most common maturity - the length of time before a bond becomes repayable - is three months, although they can have a maturity of up to one year. T-bills in a country's own currency are generally the safest possible investment. They are usually sold at a discount from their nominal value - the value written on them - rather than paying interest. For example, a T-bill can be sold at99% of the value written on it, and redeemed or paid back at 100% at maturity, three months later.

(Professional English in Use. Finance)

- Commercial paper is a short-term loan issued by major companies, also sold at a discount. It is unsecured, which means it is not guaranteed by the company's assets.

- Certificates of deposit (or CDs) are short- or medium-term, interest-paying debt instruments - written promises to repay a debt. They are issued by banks to large depositors who can then trade them in the short-term money markets. They are known as time deposits, because the holder agrees to lend the money - by buying the certificate - for a specified amount of time.

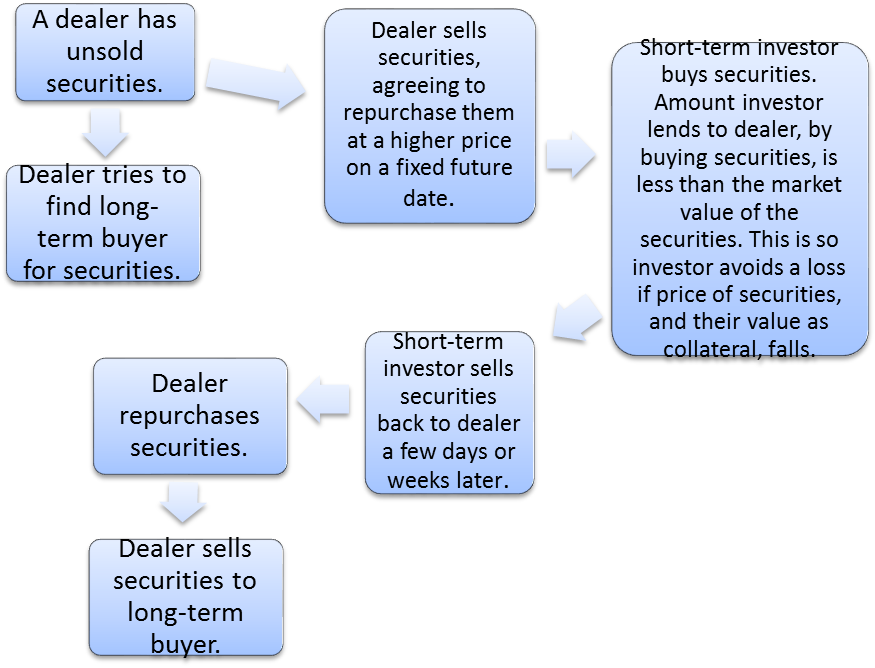

C Repos

Another very common form of financial contract is a repurchase agreement (or repo). A repo is a combination of two transactions. The dealer hopes to find a long-term buyer for the securities before repurchasing them.

• Short-term investor buys securities. Amount investor lends to dealer, by buying securities, is less than the market value of the securities. This is so investor avoids a loss if price of securities, and their value as collateral, falls.

Не нашли, что искали? Воспользуйтесь поиском: